The Ultimate Guide To Consolidation Loans

Wiki Article

What Does Bad Credit Loans Do?

Table of ContentsConsolidation Loans for DummiesHow Consolidation Personal Loans can Save You Time, Stress, and Money.Little Known Questions About Personal Loans.The Ultimate Guide To Consolidation LoansThe Greatest Guide To Personal Loan For Debt ConsolidationThe Buzz on Loan Consolidation Companies

What to do currently, The front runner you need to make is the sort of lending, If you're really feeling unclear regarding which type of car loan is best for you: review our overview to the different kinds of lendings - my site. The crucial options you have to make about the kind of lending are: If you're taking into consideration a low-down payment conventional loan, there are also exclusive home loan insurance policy alternatives.A housing counselor can additionally aid you determine which sort of car loan is best for your situation. Next off, take into consideration whether you wish to pay factors, obtain lending institution debts, or neither, Lender credits are rebates from the loan provider that offset your closing costs - bad credit loans. Points, also recognized as discount rate points, are in advance charges you pay to your loan provider in exchange for a lower rate of interest rate.

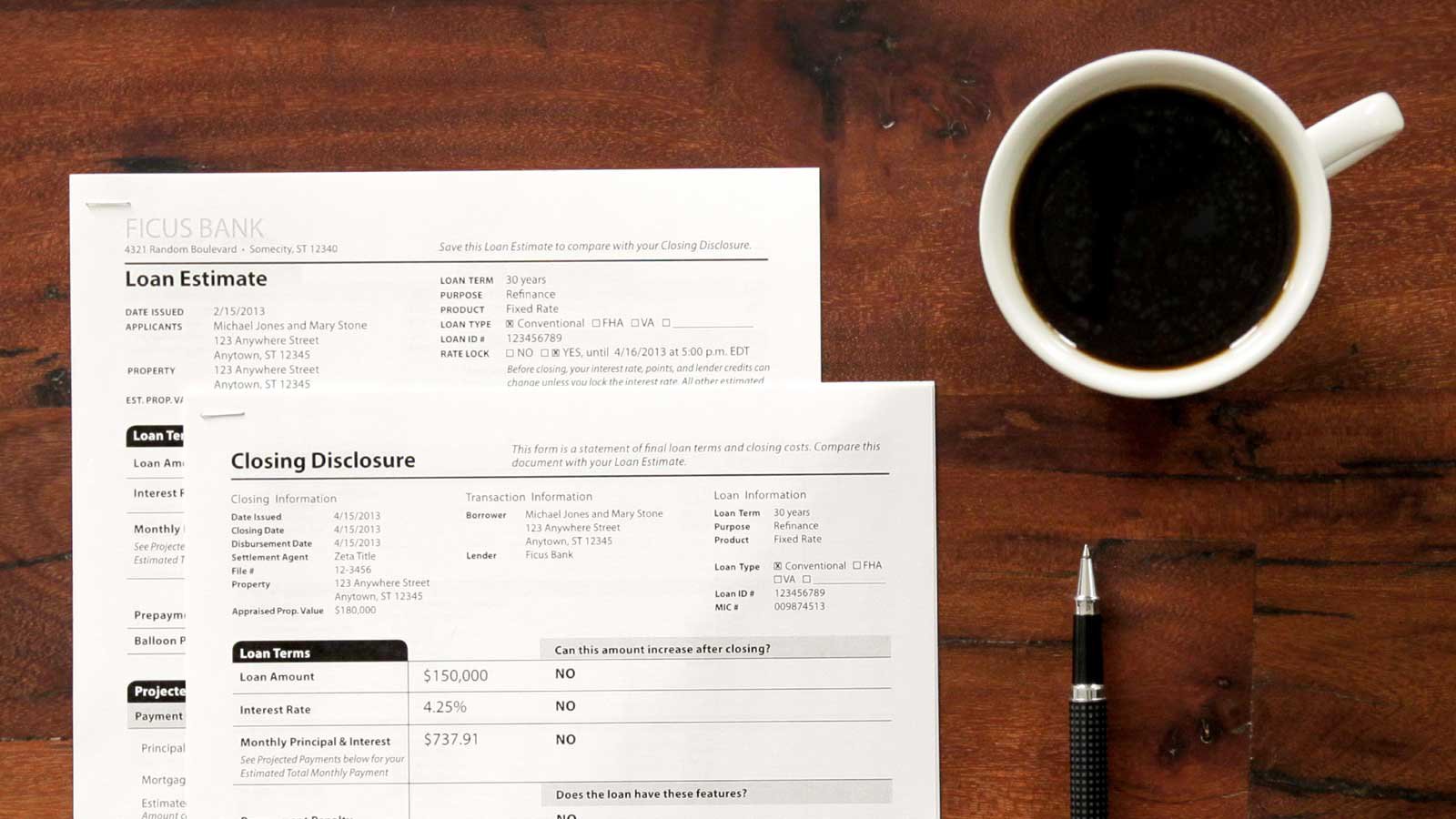

If you have an interest in thinking about a loan with either factors or credit reports, ask each lender to show you two choices one with points or credit histories, as well as one without. Comparing two alternatives side by side is the most effective method to identify which is the much better bargain. Contrast just how much cash money you need to contend closing, the monthly settlement, and how much passion you will pay over the time you expect to be in your house.

The Ultimate Guide To Loan Consolidation Companies

These worksheets are extremely useful for analyzing your choices beforehand, before you have discovered a residence or picked a lender. They are not a company deal. As soon as you've located a house you wish to get, request formal Financing Price quotes from each of the loan providers you are taking into consideration - loan consolidation companies.

It's a good idea to know what sort of funding you want prior to you ask for Car loan Quotes. This way, you'll get offers from each loan provider for the exact same sort of finance, and you can compare them to see which is the most effective deal. How much time you plan to maintain the car loan matters, When contrasting two potential loan options, it's a great suggestion to think about the quickest and also the lengthiest quantity of time you can see on your own maintaining the lending.

And an adjustable-rate mortgage might begin with navigate to this website a lower regular monthly payment, but can be dangerous if you keep the funding after the preliminary rate of interest runs out. Find out what is the quickest, most likely, as well as longest variety of years you expect to keep the funding. Ask funding police officers or a housing counselor to help you compute out the complete prices of a loan over each of your 3 timeframes.

Some Ideas on Consolidation Personal Loans You Need To Know

Don't count on being able to refinance, Refinancing can usually be advantageous for mortgage consumers. And also if rates rise in the future, there might not be any type of benefit to refinancing.

Unless you can acquire your home completely in cash money, discovering the ideal property is just half the battle. The various other half is picking the very best type of mortgage. You'll likely be repaying your mortgage over an extended period of time, so it is necessary to find a finance that satisfies your needs and budget.

The Greatest Guide To Loan Consolidation Companies

Trick Takeaways Both primary components of a home loan are major, which is the funding amount, and also the passion billed on that particular principal. The united state government does not function as a home loan lending institution, yet it does ensure particular sorts of mortgage. The six main kinds of home loans are traditional, conforming, nonconforming, Federal Housing Administration-insured, UNITED STATE

How Personal Loans can Save You Time, Stress, and Money.

An additional variable involved in pricing a mortgage is the annual percent price (APR), which analyzes the total expense of a lending. APR includes the rate of interest and other lending costs. The Six Main Kind Of Mortgages Not all home mortgage items are developed equal. Some have much more stringent guidelines than others.To certify for some kinds of fundings, you need excellent credit. The U - Funding Hub.S. government isn't a lender, yet it does guarantee certain kinds of fundings that fulfill rigid eligibility demands for earnings, funding restrictions, as well as geographical locations.

Traditional Home mortgages A conventional financing is a financing that is not backed by the federal government., two government-sponsored enterprises that get and market most standard mortgages in the United States.

Guaranteed Debt Consolidation Loans Things To Know Before You Get This

Some lending institutions additionally supply traditional fundings with low down payment requirements and no personal mortgage insurance. Adjusting Home Loan Loans Conforming lendings are bound by optimum financing restrictions established by the federal government.

Report this wiki page